-40%

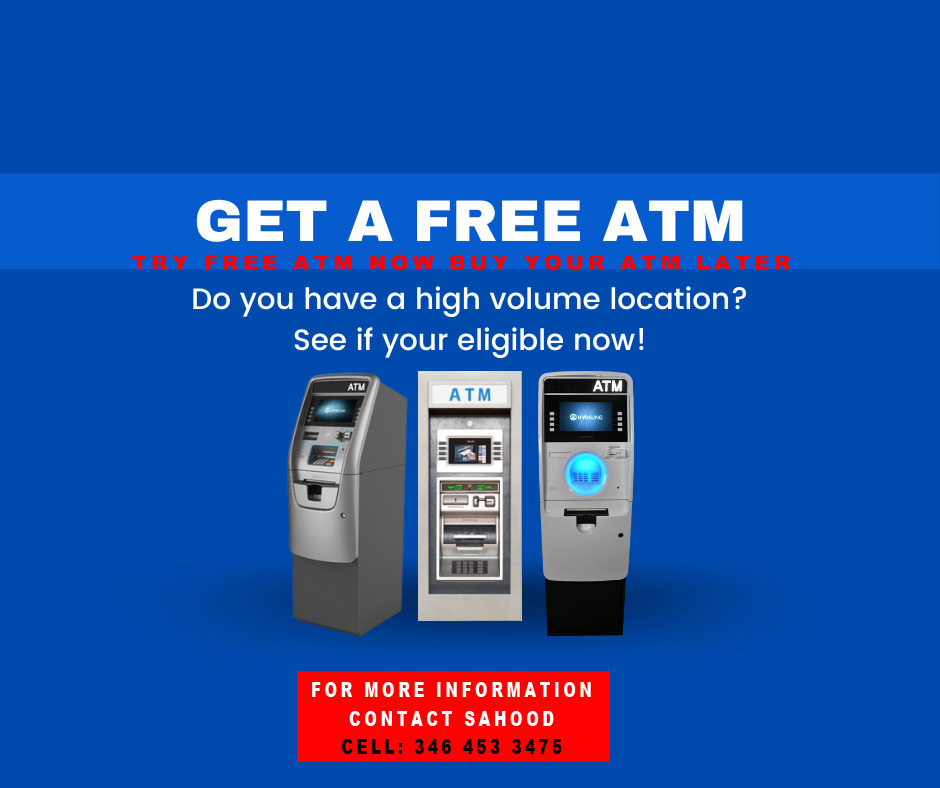

FREE ATM- BUSINESS EQUIPMENT FINANCE & ACCESSORIES

$ 3.16

- Description

- Size Guide

Description

Your business needs options.Find the Best financing Solution for your Business.

Learn More About Our

Fast & Easy

Process For Finding You

The

BEST BUSINESS LOAN IN THE MARKET TODAY

TERM LOAN:

Loan Amounts of ,000 - Million

6 Months - 10 Year Terms

Funding in 1 - 3 Days

LINE OF CREDIT:

Line Amounts of ,000 - Million

6 Months - 10 Year Terms

Funding in 1 - 3 Days

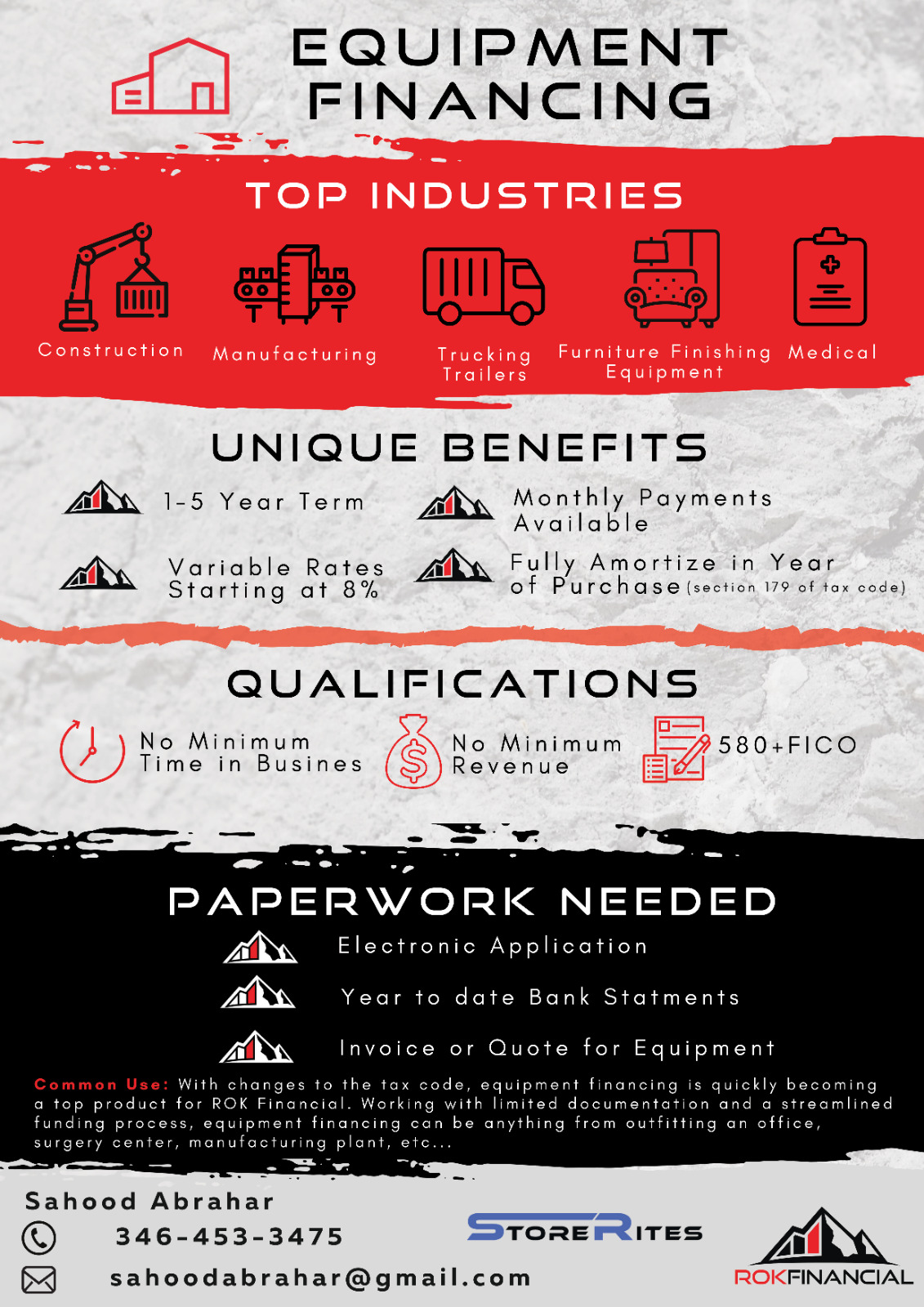

EQUIPMENT FINANCING:

Loan Amounts of ,000 Million

1 - 5 Year Terms

Funding in 1 - 3 Days

SBA LOANS:

Funds in as little as 45 Days

Amount ,000 to , Million

10-25 years terms

AR FINANCING:

Get Funds in 2 to 5 Days

,000 to , Millions

6 Months to 10 Years

Terms

MERCHANT CASH ADVANCE

Same Day Funding

,000 - , Million

Flexible Financing Terms

ASSET BASED LOANS

Same Day Funding

,000 to , Million

1-5 Years Terms

FRANCHISE FINANCING

Gets Funds in 2-7 Days

,000- , Millions

6 Months- 10 Years Terms

REAL ESTATE FIX N FLIP LOANS

Rates Starting at 8.99%

80% - 100% Funding Available

650 Minimum FICO Score Required

CREDIT CARD PROCESSING

Save 20% - 30% on Processing Fees

Free Cost saving Analysis

Next Day Funding

BUSINESS STARTUP FUNDING

Same Day Funding

,000 - ,Million

1-5 Years Terms

Best financing Solution for your Business.

1.

TERM LOAN

2.

BUSINESS

LINE OF CREDIT

3.

EQUIPMENT FINANCING

4.

SBA LOANS

5. AR FINANCING

6.

MERCHANT CASH ADVANCE

7.

ASSET BASED LOANS

8.

FRANCHISE FINANCING

9. REAL ESTATE FIX N FLIP LOANS

1

0.

BUSINESS STARTUP FUNDING

1

1. MERCHANT ACCOUNT CREDIT CARD PROCESSING

BENEFITS

SIMPLE APPLICATION:

Our simple

15 second

online application can get you matched with offers in minutes.

NO FICO MINIMUM :

Bad credit?

No problem! Most of our top financing options have no minimum FICO.

LARGE AMOUNT:

Get matched with the best financing options with the

highest

funding amount.

SAME DAY FUNDING:

Our

Fin-tech Speed

can get you in and out of Underwriting in just a few hours, and

same day funding!

s.

e minimum rev

stion of

"

How do small business loans work

or starting a small business.

Small business loans allow existing or startup companies to borrow money from various lenders. Various loan types exist to help entrepreneurs meet different goals. The way each loan works depends on the type of loan.

Maybe you've come up with that product that has the market beat. Or, maybe you need a piece of equipment that would tip your business's growth over the top. Or, maybe outstanding invoices have you in need of funds for operating costs. Whatever it may be, it may be time for a loan.

What is a small business loan?

So, what is a small business loan? Simply put, a small business loan is any funding option specifically designed for a small business. Small business loans allow existing or startup companies to borrow money from various lenders. Various loan types exist to help entrepreneurs meet different goals. The way each loan works depends on the type of loan.

There are many business loans on the market and it can be beneficial to go over just a few of them.

Term Loan

- A standard bank-type loan. You receive the funding and pay off the principle plus interest over time.

Equipment Financing

- An excellent way for a growing business to get an edge. You receive the equipment upfront and pay it off over the life of the equipment.

Accounts Receivable Financing

- If you have large amounts of outstanding invoices, you can borrow against them. The invoices act as collateral and AR Financing offers lower rates.

Merchant Cash Advance

- A merchant cash advance is borrowed against future credit card sales. A borrower then pays back a percentage of daily CC sales to the lender. So, you never have to see the payments!

Business Line of Credit

- A business line of credit works just like a non-physical credit card. The owner of a small business is extended a line of credit and is charged the interest only or what is spent.

Have Questions?

Speak with

us or send message on Ebay

Business Financing Advisor today

O

We have financing options for all credit profiles. There is no minimum FICO score required to apply.

The question of

"